Older Millennials: Growing Up and Settling Down

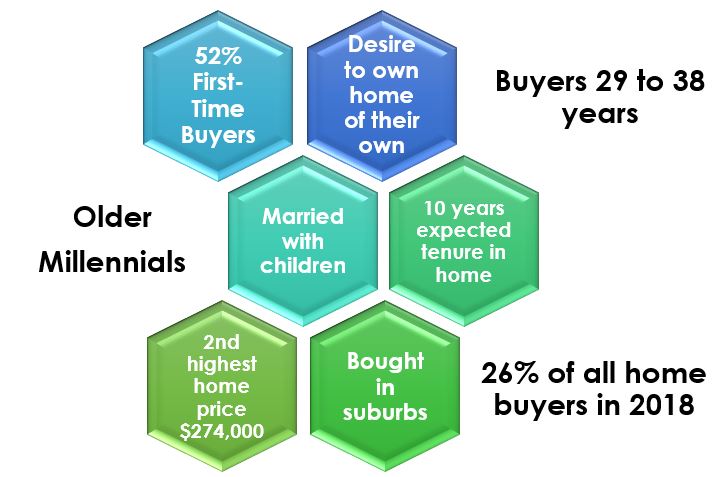

New in this year’s report, the 2019 Home Buyer and Seller Generational Trends, is the segmentation of Millennials into two cohorts. Older Millennials, buyers aged 29 to 38 years, made up the largest share of home buyers by generation at 26 percent of all home buyers in 2018. This group was born between 1980 and 1989 and was the largest share of buyers for the sixth consecutive year. Sixty-nine percent of Older Millennials were married couples and 13 percent were unmarried couples. Older Millennials had the largest families, overtaking Generation X this year—with 58 percent having one or more children living at home.

Older Millennials were the second most likely to rent an apartment (48 percent) or live with friends or family (14 percent) as their previous living arrangement. The primary reason that Older Millennials purchased homes was the desire to own a home of their own at 42 percent, and they stated that it was just the right time to buy (53 percent).

Older Millennials accounted for the second largest share of first-time home buyers at 52 percent. This generation primarily bought previously owned homes (88 percent) for a better price (37 percent) and new homes (12 percent) to avoid renovations or problems with electricity and plumbing (51 percent). Older Millennials accounted for the second smallest share that purchased multi-generational homes at nine percent. When they purchased multi-generational homes, the primary reason was to take care of aging parents at 33 percent.

Older Millennials were the second most likely to purchase in the suburbs or a subdivision at 53 percent behind Generation X. They purchased within a median of 10 miles from their previous residence, the same as Younger Millennials. More than other age groups, they purchased homes for the quality of the neighborhood (63 percent), convenience to a job (61 percent), and overall affordability of homes (44 percent).

They had a median household income of $101,200 in 2017. They purchased the second most expensive homes at a median home price of $274,000. This generation of buyers purchased larger homes in size at a median square feet of 1,900. They also purchased older homes at a median year of 1984.

Commuting costs were important to Older Millennials, 39 percent said this was very important. Compared to other generations, both Millennial groups were the most likely to say that they compromised on the price of the home, distance from their job, condition of the home, size of the home, and lot size. Older Millennials had the shortest expected tenure in the home at a median of 10 years.

Older Millennials financed their home purchase at 97 percent, the same as Younger Millennials. The median percent financed was 91 percent, the highest share among the generations. Older Millennials were likely to use savings (73 percent) and a gift or loan from a friend or relative (21 percent) as the source of their downpayment. Older and Younger Millennial buyers were the most likely to say saving for the downpayment was the most difficult step in the home buying process. Among those who had difficulty saving, 59 percent of Older Millennials had student loan debt and 35 percent had car loans, more than other age groups. Overall, 42 percent of Older Millennial home buyers had student loan debt. Older Millennials were the most likely to feel that their home purchase was a good financial investment at 88 percent.