Redfin Survey: Homebuyers Face Rising Mortgage Rates Head On

As expected, mortgage rates have crept up from below 4 percent in late 2017 to greater than 4.5 percent in June for an average 30-year fixed-rate mortgage. But few homebuyers are halting their searches.

In May, Redfin commissioned a survey of more than 4,000 people who had bought or sold a home in the last year, attempted to do so, or planned to do so soon.

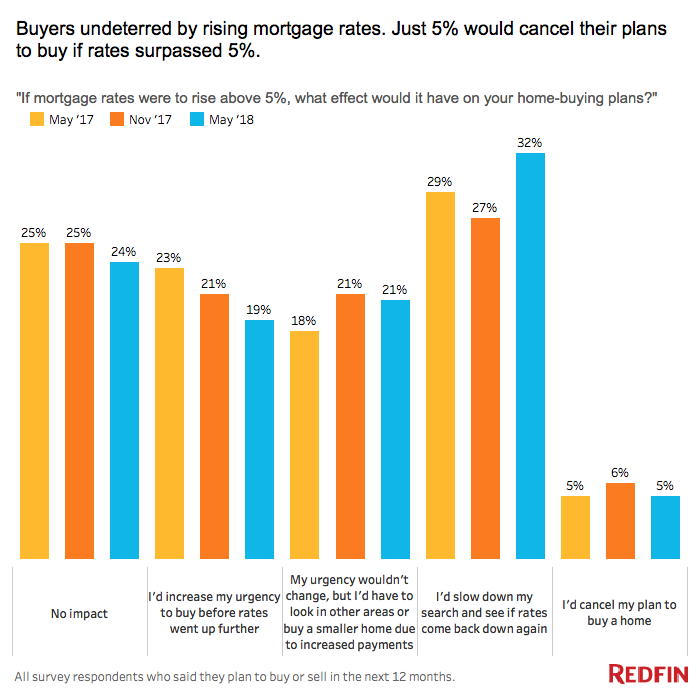

Among the more than 1,300 respondents who planned to buy a home in the coming year, just 5 percent said they’d call off their search if rates rose above 5 percent. Twenty-four percent of buyers said such an increase would have no impact on their search. These results are consistent with those from similar surveys Redfin commissioned in May and November of 2017.

“Homebuyers are well aware that higher mortgage rates means higher monthly payments, but mortgage rates remain very low, historically, and buyers will make compromises,” said Taylor Marr, senior economist at Redfin. “Most of the pressure buyers are feeling is from competition for a very limited number of homes for sale. The fact that such a small share of buyers will scrap their plans to buy a home if rates surpass 5 percent reflects their determination to be a part of the housing market.”

More willing to adjust criteria, slightly less urgency:

Here’s how buyers said they would react if mortgage rates were to rise above 5 percent:

- 32% would slow down their search and wait to see if they came back down again, up from 27% in November and 29% in May 2017.

- 21% said a 5% mortgage rate would cause them to look in other areas or buy a smaller home, unchanged from November and up from 18% a year ago.

- 19% would increase their urgency to buy before rates went up further, down from 21% in November and from 23% a year ago.

Methodology

Redfin contracted SurveyGizmo to field a study between May 1 and 18, 2018 of 4,264 people from the general population who indicated they had bought or sold a home in the past year, tried to buy or sell a home in the past year or plan to do so this year. This report focused on responses from the 1,315 people who indicated they plan on trying to buy a home in the next 12 months. The survey targeted 14 major metro areas (Austin, Baltimore, Boston, Chicago, Dallas-Fort Worth, Denver, Los Angeles, Phoenix, Portland, Sacramento, San Diego, San Francisco, Seattle and Washington, D.C.).

Comparisons were made using results from similarly commissioned surveys conducted by SurveyGizmo in May and November 2017.

For more information about the survey and its findings, contact Redfin Journalist Services at press@redfin.com.

The post Redfin Survey: Homebuyers Face Rising Mortgage Rates Head On appeared first on Redfin Real-Time.