The Ultimate Guide to Buying a House in California

If you’re looking to buy a house in California, you’re in for an exciting journey. However, navigating the complex real estate market in the Golden State can be daunting, especially if you’re new to the process.

That’s why we created this guide to help explain the steps and provide you with the information you need to make informed decisions. From comprehending the local housing market to securing financing and closing the deal, we’ve got you covered. Whether you’re a seasoned or first-time homebuyer, you’ll have all the necessary tools and knowledge to find and purchase your dream home in California. So, let’s begin.

What’s it like to live in California?

Get ready for a one-of-a-kind and thrilling experience because living in California is like no other. From the stunning beaches and mountains to the bustling cities, the Golden State offers a diverse range of lifestyles and opportunities. The warm and sunny climate allows for year-round outdoor activities, including hiking, surfing, and skiing. The state is also home to world-renowned entertainment and cultural destinations, such as Hollywood, Disneyland, and Napa Valley. However, with all its glamor and beauty, living in California can come with a higher cost of living and traffic congestion in urban areas. But, for those willing to embrace the California lifestyle, it can be a truly unforgettable place to call home. Check out this article to learn more about the pros and cons of living in California

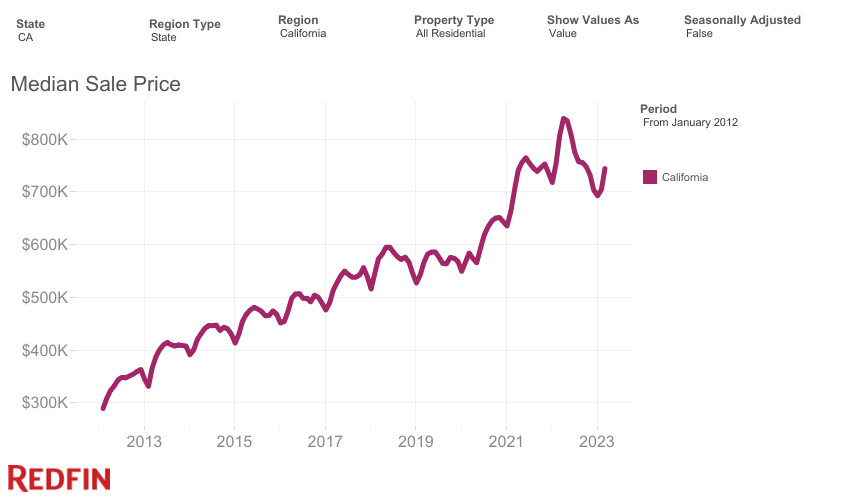

An overview of the California housing market

The housing market in California is known for being one of the most expensive in the United States. You’ll find intense competition, with many properties receiving multiple offers and selling above the asking price. The cost of housing varies significantly depending on the location, with major cities such as San Francisco and Los Angeles commanding some of the highest prices. You can also expect to pay more in coastal cities like San Diego and Newport Beach. However, the more inland you go, the less you’ll pay.

Over the past 10 years, the median sale price has been steadily climbing. However, there has been a slight decrease as of recently. The current median sale price in California is $765,400, which is a 9% decrease from 2022.

Finding your perfect location in California

Choosing the perfect location to settle down in California can be a daunting task given the state’s diversity and size. The good news is that there is a wide range of options to suit various preferences. For an urban lifestyle, San Francisco, Los Angeles, and San Diego offer a plethora of job opportunities, entertainment options, and cultural attractions. The Central Coast and wine country areas like Napa and Sonoma are perfect for those looking for a slower pace of life with world-class wineries and stunning scenery. Outdoor enthusiasts can enjoy the Sierra Nevada or Lake Tahoe region with access to year-round recreational activities. No matter what your preference, California’s diverse landscape has something to offer.

Here’s a list of some of the most sought-after cities in California, along with information on their respective housing markets. If you’re between two cities, using tools like a cost of living calculator can help you decide within budget.

#1: San Francisco, CA

Median home price: $1,350,000

San Francisco, CA homes for sale

San Francisco is home to some of the most iconic landmarks in the world. You’ll find the Golden Gate Bridge, cable cars, and Alcatraz Island. Living in San Francisco offers many world-class restaurants and bars, offering a variety of cuisines and experiences, but at a price. This city has a reputation for being one of the most expensive cities in the country, and compared to Los Angeles, the cost of living in San Francisco is about 19% higher. Despite this, the city’s unique charm and vibrant energy continue to make it a great place to call home.

#2: San Jose, CA

Median home price: $1,175,000

San Jose, CA homes for sale

Living in San Jose offers a unique lifestyle combining California’s natural beauty with the hustle and bustle of a tech-driven economy. The city is known for its booming tech industry, with many residents working for major companies such as Apple, Google, and Facebook. The city also strongly focuses on sustainability and is a leader in green technology and initiatives. If the hustle and bustle aren’t for you, here are San Jose suburbs to consider living in.

#3: Los Angeles, CA

Median home price: $912,500

Los Angeles, CA homes for sale

Popular Los Angeles neighborhoods

As one of the largest cities in the United States, Los Angeles offers residents a hub of diverse cultures, lifestyles, and industries. The city is renowned for its beautiful beaches, sunny weather, and endless entertainment options, including world-class dining, shopping, and nightlife. However, living in Los Angeles can also have challenges, including heavy traffic, high living costs, and air pollution. Although Los Angeles is known for its high housing costs, there are affordable Los Angeles suburbs to choose from.

#4: San Diego, CA

Median home price: $852,250

San Diego, CA homes for sale

Popular San Diego neighborhoods

Living in San Diego boasts some of the most beautiful beaches in the country, with a mild Mediterranean climate that makes outdoor activities possible all year round. San Diego is also home to a thriving food scene, with various cuisine options, from high-end dining to street tacos. The city has a laid-back vibe, with a strong focus on health and wellness, with activities such as hiking, surfing, and cycling. You’ll find popular neighborhoods like La Jolla and Ocean Beach. But if you’re looking for more affordable options, you’ll want to check out affordable San Diego suburbs.

#5: Sacramento, CA

Median home price: $466,500

Sacramento, CA homes for sale

Living in Sacramento offers a rich history, with many museums and landmarks that showcase California’s past. Sacramento is also home to a thriving arts and culture scene, with different music, theater, and festivals throughout the year. The city is located at the confluence of two major rivers, the American and the Sacramento, making it a popular destination for outdoor enthusiasts who enjoy fishing, kayaking, and other water activities. The cost of living in Sacramento is generally lower than in other major cities in California, in fact, Sacramento is 41% less than housing in San Jose.

The homebuying process in California

If you determined that California is the state for you and narrowed down the perfect location, let’s dive into what the homebuying process looks like.

1. Get your finances together

When buying a house in California, determining a budget that aligns with your financial situation is essential. Using tools such as an affordability calculator can help you understand how much you can afford to pay each month. However, when setting a budget, it’s important to factor in additional costs such as down payments and closing costs.

There are a few first-time homebuyer programs in California that can offer assistance. The CalHFA MyHome Assistance Program offers first-time homebuyers up to a $10,000 down payment and/or closing cost assistance. Being aware of these available programs can significantly benefit your homebuying journey.

2. Get pre-approved from a lender

Getting pre-approved for a mortgage should be one of your first steps when buying a house in California. A pre-approval helps determine the price range of homes you can afford. This involves submitting financial documents to the lender, such as tax returns and credit reports. The lender will then use this information to assess your financial situation and determine the maximum loan amount they are willing to offer you. Check out this article to learn more about how to get pre-approved for a mortgage.

3. Connect with an agent

Working with a local California real estate agent is an important step in the homebuying process because they have the local knowledge and expertise to guide you through the entire process. A good agent will help you identify properties that meet your needs and budget, negotiate on your behalf, and help you navigate the complex paperwork and legal requirements of buying a home. Whether you’re looking for a real estate agent in Los Angeles or an agent in San Diego, there are plenty of local agents ready to help you.

4. Search for homes

Touring homes is a crucial step in the process of buying a home in California. You can assess the property’s condition, evaluate its features and amenities, and determine whether it meets your needs and preferences. It’s also an opportunity to ask questions and get more information from the seller or their agent, which can help you make a more informed decision. In California, touring homes can be done by attending open houses, scheduling private showings with a real estate agent, or even taking virtual tours. Read this article to learn more about what to look for when touring homes in California.

5. Make an offer

The next step in the homebuying process in California is making an offer. An offer involves submitting a written proposal that includes the purchase price, any contingencies or conditions, and a proposed closing date. The seller can accept your offer, reject it, or make a counteroffer. Negotiating the terms of the sale can take several rounds of back-and-forth communication between you and the seller, so it’s important to be patient and flexible throughout the process. In California’s competitive housing market, it’s not uncommon for there to be multiple offers on a property, so it’s important to work with your agent to craft a strong offer that stands out to the seller while also protecting your interests as a buyer.

6. Close on the house

The final step in the homebuying process in California is closing on the house. During the closing process, the buyer and seller will sign several legal documents, including the deed, mortgage agreement, and title transfer. The buyer will also be required to pay closing costs, including loan origination, appraisal, and title search fees. In California, it’s important to note that the state requires a property to undergo a natural hazard disclosure, which alerts buyers to potential natural hazards such as earthquakes, wildfires, and flooding. Once all the necessary documents have been signed and the funds have been transferred, the title company will record the new deed with the county recorder’s office, and the buyer will officially become the new owner of the property.

Are you a first-time buyer? Learn more about the entire homebuying process through our First-Time Homebuyer Guide.

Unique factors that differentiate the buying process in California

Buying a home in any state can vary, from the types of loans and taxes to the insurance and disclosures. Knowing how things may differ when purchasing a home in California is essential for those looking to move.

Natural disasters and climate risks are common

California is particularly vulnerable to a variety of natural disasters, including wildfires, earthquakes, drought, and floods. California’s dry and hot climate makes wildfires a frequent occurrence, causing significant damage to homes and properties. Additionally, the state is at a high risk of earthquakes due to its location along several fault lines. Flooding is also a risk in some areas, particularly those near rivers or in low-lying regions. It’s important for homeowners to be prepared and take necessary precautions, such as purchasing homeowners insurance that covers natural disasters, maintaining their property to reduce wildfire risk, and having an earthquake preparedness plan in place. When purchasing a home in California, it’s crucial to research the area’s history of natural disasters and take steps to mitigate potential risks.

Home insurance and Mello-Roos taxes

Homeowners insurance is an essential aspect of buying a house in California. With the state’s high risk of natural disasters, having a comprehensive insurance policy can provide much-needed peace of mind. Homeowners insurance typically covers damages caused by fire, theft, and natural disasters, but policies can vary, so it’s crucial to read the fine print carefully. The average cost of homeowners insurance in California is around $1,300 per year, but this can vary based on several factors, such as the value of the property and location.

Additionally, some California communities levy Mello-Roos taxes, which are special taxes imposed on property owners to fund public infrastructure and facilities like schools and parks. These taxes can add high costs to owning a home, and it is essential for prospective buyers to research whether the property they are interested in is subject to Mello-Roos taxes and to factor these costs into their budget.

Dual agency is permitted in California

A dual agency is a legal practice in California where a single real estate agent represents the buyer and the seller in a transaction. While this can be convenient for both parties, buyers need to understand the implications of dual agency. In this scenario, the agent owes fiduciary responsibilities to both parties, which can create a conflict of interest. While a dual agency is permitted in California, buyers must understand their options and make informed decisions when choosing a real estate agent.

Seller’s disclosures are thorough

In California, sellers’ disclosures play an essential role in homebuying. Sellers must disclose any known material defects and provide a Natural Hazard Disclosure informing the buyer if the property is located in a hazard zone such as a floodplain or earthquake zone. California also has additional requirements, such as disclosing any death on the property within the past three years and any upgrades or modifications made without the proper permits.

You do not have to be present at close

You don’t have to be physically present to close on a house in California. Signing and completing all necessary paperwork remotely, including through electronic signatures and virtual notarization, is possible.

Buying a house in California: Bottom line

From determining your budget and obtaining pre-approval for a mortgage to working with a real estate agent and touring homes, there are several steps you need to take to ensure a successful purchase. It’s also important to consider additional factors such as property taxes, home insurance, and protection against natural disasters like wildfires and droughts. By understanding the unique challenges and opportunities of the California housing market and working with experienced professionals, you can find the home of your dreams and enjoy all the benefits of living in one of the country’s most vibrant and dynamic regions.

Buying a house in California FAQ

How much money do you need to buy a house in California?

The amount of money you need to buy a house in California can vary widely depending on several factors, including the location of the property, the size and condition of the home, your down payment, and your credit score. In California’s competitive housing market, it’s common for buyers to make offers that exceed the asking price, which can require a larger down payment and additional funds to cover closing costs. Additionally, California’s high home prices mean that buyers often need to secure larger mortgages than in other parts of the country. The median list price in California is $765,400, and if you’re looking at cities like Los Angeles where the median sale price is $987,000, buyers should expect to have a significant amount of cash on hand to cover their down payment, closing costs, and other expenses.

How much downpayment do you need for a house in California?

The down payment required for a house in California can vary depending on the home’s purchase price and the loan type you use to finance the purchase. Generally, conventional loans require a down payment of at least 5% to 20% of the purchase price, while government-backed loans such as FHA loans may require as little as 3.5% down.

What is a good credit score to buy a house in California?

The credit score required to buy a house in California will depend on the mortgage loan you are applying for. Generally, a credit score of 620 or higher is considered a good score for a conventional mortgage loan. Government-backed loans such as FHA loans may accept lower credit scores, sometimes as low as 500. However, remember that a higher credit score can increase your chances of being approved for a loan and may help you secure a more favorable interest rate.

Is it worth it to buy real estate in California?

California has one of the most expensive housing markets in the United States, with high median home prices and relatively high property taxes and insurance costs. However, California is also home to many prosperous cities with strong economies, diverse job opportunities, and a desirable lifestyle. Overall, buying real estate in California can be a wise long-term investment if you can afford it and the location and property align with your personal and financial goals.

The post The Ultimate Guide to Buying a House in California appeared first on Redfin | Real Estate Tips for Home Buying, Selling & More.