Together, Uber Employees Could Buy Every Single Home for Sale in San Francisco, Oakland and Berkeley with their IPO Cash

The enormous public offering could put further pressure on the Bay Area housing market, already the most expensive in the country.

With the wealth created through Uber’s massive upcoming IPO, current and former employees of the business could buy every single home for sale in San Francisco, Oakland and Berkeley combined, in cash—and still have about $400 million left over. Or, they could purchase nearly half of the homes for sale in the entire Bay Area.

That’s based on an IPO price of $47 per share, the midpoint of the ridehailing company’s proposed price range of $44 to $50 per share. Using the $47-per-share price, current and former employees hold roughly $3.32 billion worth of stock in the San Francisco-based company.

If all $3.32 billion of the total stock wealth were to go into the San Francisco Bay Area real estate market once the IPO lockup period ends, current and former Uber employees could hypothetically buy:

- All 1,612 homes for sale in San Francisco, Oakland and Berkeley combined for $2.9 billion.

- All 853 homes for sale in the city of San Francisco for $2.2 billion, and have $1.1 billion left over.

- All 1,272 homes for sale in the city of San Jose for $1.47 billion, and have nearly $1.9 billion left over.

- All 643 homes for sale in the city of Oakland for $510.1 million.

- All 116 homes for sale in the city of Berkeley for $165 million.

- Nearly the entire bottom half of homes for sale by list price—7,551 homes—across the Bay Area (the San Jose-San Francisco-Oakland combined statistical area) for $3.32 billion.

- The top 2% of homes for sale by list price—223 homes—in the entire Bay Area for $3.32 billion.

Lyft, the other big ridehailing business based in San Francisco, went public at the end of March. At that time, we calculated that current and former Lyft employees could have purchased every home for sale in the city of San Francisco based on the company’s IPO price.

Put that together with the wealth from Pinterest’s recent IPO and the wealth that’ll soon be created by Uber’s IPO, and factor in the smaller but still major public debut expected to come down the pipeline from San Francisco-based Slack this year, and there will be billions and billions worth of cash that could potentially be poured into the Bay Area real estate market.

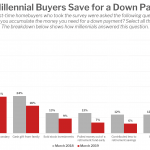

The San Francisco metro area, where the typical home sold for $1.4 million in March, is already the most expensive large housing market in the country, and San Jose, where the median home price is $1.1 million, isn’t far behind. The wealth coming down the pipeline from this year’s Bay Area tech IPOs could put further pressure on an area where housing is already unaffordable for many of its residents: Just 2.6 percent of homes in the San Francisco metro are affordable on the area’s median household income of $101,714.

“The Uber IPO, along with the other large tech companies going public this year, is likely to have a large and lasting impact on Bay Area real estate,” said Redfin chief economist Daryl Fairweather. “Given the existing shortage of housing, competition among newly wealthy buyers will drive up prices. Less fortunate locals will move inland or out of state in search of affordable homes and lifestyles.”

Methodology

For this report, we used Uber’s S-1 filing, combined with Redfin data, to determine the number of homes (single-family homes, townhouses and condos) current and former Uber employees could hypothetically purchase with their stock wealth from the company’s upcoming IPO. Current and former Uber employees held approximately $1.5 billion worth of vested stock options, plus $21.7 million worth of vested SARs. They also hold 38.3 million shares underlying RSUs that will have satisfied vesting conditions upon the IPO’s completion and that will be left after obligatory tax withholding in connection with vesting. We multiplied the number of shares by $47, the midpoint of Uber’s proposed IPO price, to get $1.8 billion. Altogether, the forthcoming stock wealth is worth roughly $3.32 billion. We looked at all of the active listings in the city of San Francisco and the San Jose-San Francisco-Oakland combined statistical area. Then, we took the aggregate value of the Uber stock wealth and created a running total of list prices in each of those regions until the $3.32 billion was exhausted. We repeated the process for the cities of Oakland, Berkeley and San Jose.

The post Together, Uber Employees Could Buy Every Single Home for Sale in San Francisco, Oakland and Berkeley with their IPO Cash appeared first on Redfin Real-Time.